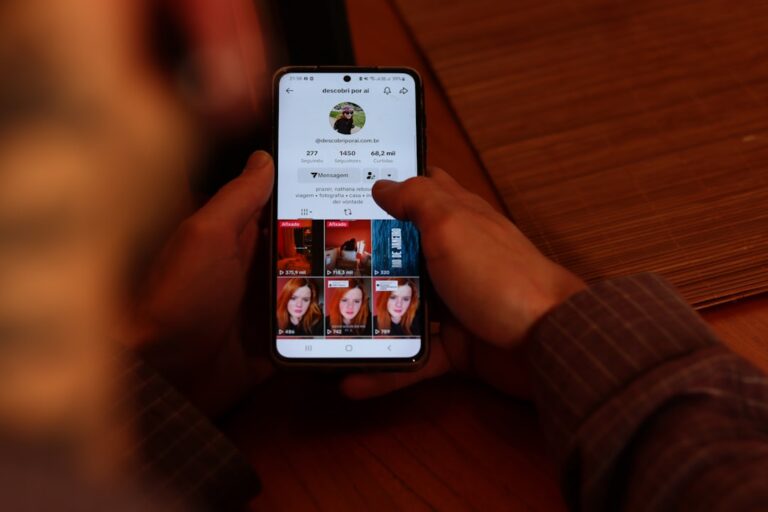

AI App Issues Apology Following Inaccurate Crime Alerts Nationwide

An AI app designed to send crime alerts mistakenly issued false notifications across the U.S., causing public panic and eroding trust in its reliability. Developers have apologized and committed to improving the system's accuracy, highlighting the need for vigilant oversight in AI applications for public safety.